Southeast Asian Fintech Adoption to Hit 60% by 2030, UnaFinancial Says

Tuesday, 06/08/2024 | 11:27 GMT by Damian Chmiel

- The Philippines leads the region in mobile fintech usage, with Indonesia showing the fastest growth.

- Digital wallets and mobile banking are two leading segments of popular apps.

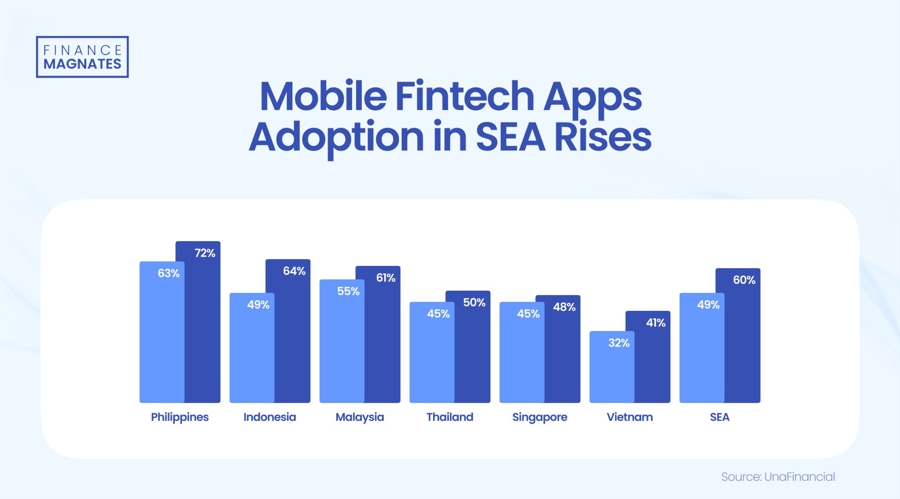

A new study by UnaFinancial reveals that mobile fintech app adoption in Southeast Asia is on track to reach 60% by 2030, up from 49% in 2024. The research highlights significant growth in the region’s digital financial services sector, with some countries poised for particularly high penetration rates.

Southeast Asian Fintech App Adoption Set to Surge by 2030

The study, which analyzed data from over 8,700 apps across six Southeast Asian nations, found that the Philippines currently leads the region with a 63% adoption rate. This is expected to climb to 72% by 2030, maintaining the country’s top position.

Sergey Sedov, the CEO of UnaFinancial

“The leadership of the Philippines is due to several factors, including the large share of the unbanked population, efforts of regulators to develop digital financial technologies, a large proportion of young and tech-savvy population and a growing level of mobile and Internet penetration,” explained a UnaFinancial analyst.

Indonesia has shown the most visible growth, with fintech app usage surging from 9% in 2019 to 49% in 2024. The country is projected to reach 64% adoption by 2030, securing the second spot in the region.

“The level of mobile fintech app adoption increased from 9% in 2019 to 49% in 2024. Similar to the Philippines, Indonesia is actively developing fintech, supported by government efforts and a large share of the unbanked population,” UnaFinancial added.

Other countries in the study include Malaysia, currently at 55% adoption and expected to reach 61% by 2030, Thailand (45% to 50%), Singapore (45% to 48%), and Vietnam (32% to 41%).

The development of the local fintech industry is also evidenced by the fact that Revolut recently expanded its B2B operations in Southeast Asia, providing multi-currency accounts, debit cards, and access to over 150 currencies.

The research also broke down adoption rates by fintech segments. Digital wallets and payment apps lead with 35% penetration, followed by mobile banking at 18%. Lending apps have shown significant growth, increasing from 1% in 2019 to 5% in 2024.

Investing and cryptocurrency trading apps lag behind at 2% each, which analysts attribute to reduced investment activity amid global economic uncertainty.

The study’s findings underscore the rapid digitalization of financial services in Southeast Asia, a trend that appears set to continue through the end of the decade. As these technologies become more prevalent, they have the potential to reshape the region’s financial landscape and improve access to services for millions of consumers.

UnaFinancial is one of the companies operating in the payments and fintech industry itself. At the end of July, it presented results for the first half of 2024, when it earned $4.7 million, increasing its net profit by 18%.

Fintech in ASEAN

Within the Association of Southeast Asian Nations (ASEAN), Singapore maintained a leading position in 2023 by securing $747 million in FinTech funding, representing 59% of the total funding in this region. Despite a significant drop of over 65% compared to the previous year, Singapore still managed to secure 51 deals, the most in the region, spanning eight different FinTech categories. That was the broadest range observed locally.

Digital Banking is one of the most competitive fintech sectors in SEA, according to Robocash Group.

“The future of the financial services market in SEA will undoubtedly be strongly influenced by digital banking”.

Read more: httpss://t.co/GRF2HuGbuo#fintech #future #digitalbank

— UnaFinancial (@UnaFinancial) June 16, 2023

However, Singapore and other ASEAN-based FinTech companies continue to experience a global downturn in funding. In the first nine months of 2023, fintech investments across the six largest ASEAN economies totaled US$1.3 billion, marking a drastic 70% reduction from the same period in 2022.

Last month, MUFG and the Finnoventure Private Equity Trust fund collectively invested $195 million in Ascend Money, a fintech unicorn based in Thailand. Ascend Money, a subsidiary of the Charoen Pokphand Group, has extensive operations across seven Southeast Asian countries.

A new study by UnaFinancial reveals that mobile fintech app adoption in Southeast Asia is on track to reach 60% by 2030, up from 49% in 2024. The research highlights significant growth in the region’s digital financial services sector, with some countries poised for particularly high penetration rates.

Southeast Asian Fintech App Adoption Set to Surge by 2030

The study, which analyzed data from over 8,700 apps across six Southeast Asian nations, found that the Philippines currently leads the region with a 63% adoption rate. This is expected to climb to 72% by 2030, maintaining the country’s top position.

Sergey Sedov, the CEO of UnaFinancial

“The leadership of the Philippines is due to several factors, including the large share of the unbanked population, efforts of regulators to develop digital financial technologies, a large proportion of young and tech-savvy population and a growing level of mobile and Internet penetration,” explained a UnaFinancial analyst.

Indonesia has shown the most visible growth, with fintech app usage surging from 9% in 2019 to 49% in 2024. The country is projected to reach 64% adoption by 2030, securing the second spot in the region.

“The level of mobile fintech app adoption increased from 9% in 2019 to 49% in 2024. Similar to the Philippines, Indonesia is actively developing fintech, supported by government efforts and a large share of the unbanked population,” UnaFinancial added.

Other countries in the study include Malaysia, currently at 55% adoption and expected to reach 61% by 2030, Thailand (45% to 50%), Singapore (45% to 48%), and Vietnam (32% to 41%).

The development of the local fintech industry is also evidenced by the fact that Revolut recently expanded its B2B operations in Southeast Asia, providing multi-currency accounts, debit cards, and access to over 150 currencies.

The research also broke down adoption rates by fintech segments. Digital wallets and payment apps lead with 35% penetration, followed by mobile banking at 18%. Lending apps have shown significant growth, increasing from 1% in 2019 to 5% in 2024.

Investing and cryptocurrency trading apps lag behind at 2% each, which analysts attribute to reduced investment activity amid global economic uncertainty.

The study’s findings underscore the rapid digitalization of financial services in Southeast Asia, a trend that appears set to continue through the end of the decade. As these technologies become more prevalent, they have the potential to reshape the region’s financial landscape and improve access to services for millions of consumers.

UnaFinancial is one of the companies operating in the payments and fintech industry itself. At the end of July, it presented results for the first half of 2024, when it earned $4.7 million, increasing its net profit by 18%.

Fintech in ASEAN

Within the Association of Southeast Asian Nations (ASEAN), Singapore maintained a leading position in 2023 by securing $747 million in FinTech funding, representing 59% of the total funding in this region. Despite a significant drop of over 65% compared to the previous year, Singapore still managed to secure 51 deals, the most in the region, spanning eight different FinTech categories. That was the broadest range observed locally.

Digital Banking is one of the most competitive fintech sectors in SEA, according to Robocash Group.

“The future of the financial services market in SEA will undoubtedly be strongly influenced by digital banking”.

Read more: httpss://t.co/GRF2HuGbuo#fintech #future #digitalbank

— UnaFinancial (@UnaFinancial) June 16, 2023

However, Singapore and other ASEAN-based FinTech companies continue to experience a global downturn in funding. In the first nine months of 2023, fintech investments across the six largest ASEAN economies totaled US$1.3 billion, marking a drastic 70% reduction from the same period in 2022.

Last month, MUFG and the Finnoventure Private Equity Trust fund collectively invested $195 million in Ascend Money, a fintech unicorn based in Thailand. Ascend Money, a subsidiary of the Charoen Pokphand Group, has extensive operations across seven Southeast Asian countries.

Damian’s adventure with financial markets began at the Cracow University of Economics, where he obtained his MA in finance and accounting. Starting from the retail trader perspective, he collaborated with brokerage houses and financial portals in Poland as an independent editor and content manager. His adventure with Finance Magnates began in 2016, where he is working as a business intelligence analyst.

- 1659 Articles

- 36 Followers

Keep Reading

More from the Author

-

CME Loses Key FX Benchmark Risk Expert as Jannece Announces Departure

CME Loses Key FX Benchmark Risk Expert as Jannece Announces Departure

CME Loses Key FX Benchmark Risk Expert as Jannece Announces Departure

CME Loses Key FX Benchmark Risk Expert as Jannece Announces Departure

CME Loses Key FX Benchmark Risk Expert as Jannece Announces Departure

CME Loses Key FX Benchmark Risk Expert as Jannece Announces Departure

CME Loses Key FX Benchmark Risk Expert as Jannece Announces Departure

CME Loses Key FX Benchmark Risk Expert as Jannece Announces Departure

CME Loses Key FX Benchmark Risk Expert as Jannece Announces Departure

CME Loses Key FX Benchmark Risk Expert as Jannece Announces Departure

-

3rd Largest Bitcoin Miner on Wall Street Boosts BTC Production by 45%

3rd Largest Bitcoin Miner on Wall Street Boosts BTC Production by 45%

3rd Largest Bitcoin Miner on Wall Street Boosts BTC Production by 45%

3rd Largest Bitcoin Miner on Wall Street Boosts BTC Production by 45%

3rd Largest Bitcoin Miner on Wall Street Boosts BTC Production by 45%

3rd Largest Bitcoin Miner on Wall Street Boosts BTC Production by 45%

3rd Largest Bitcoin Miner on Wall Street Boosts BTC Production by 45%

3rd Largest Bitcoin Miner on Wall Street Boosts BTC Production by 45%

3rd Largest Bitcoin Miner on Wall Street Boosts BTC Production by 45%

3rd Largest Bitcoin Miner on Wall Street Boosts BTC Production by 45%

-

Prop Firm Karma Becomes the Latest to Add Match-Trader to Its Platform Lineup

Prop Firm Karma Becomes the Latest to Add Match-Trader to Its Platform Lineup

Prop Firm Karma Becomes the Latest to Add Match-Trader to Its Platform Lineup

Prop Firm Karma Becomes the Latest to Add Match-Trader to Its Platform Lineup

Prop Firm Karma Becomes the Latest to Add Match-Trader to Its Platform Lineup

Prop Firm Karma Becomes the Latest to Add Match-Trader to Its Platform Lineup

Prop Firm Karma Becomes the Latest to Add Match-Trader to Its Platform Lineup

Prop Firm Karma Becomes the Latest to Add Match-Trader to Its Platform Lineup

Prop Firm Karma Becomes the Latest to Add Match-Trader to Its Platform Lineup

Prop Firm Karma Becomes the Latest to Add Match-Trader to Its Platform Lineup

-

CoinShares’ Q2 2024 Record Revenues Overshadowed by £22M FlowBank Impairment

CoinShares’ Q2 2024 Record Revenues Overshadowed by £22M FlowBank Impairment

CoinShares’ Q2 2024 Record Revenues Overshadowed by £22M FlowBank Impairment

CoinShares’ Q2 2024 Record Revenues Overshadowed by £22M FlowBank Impairment

CoinShares’ Q2 2024 Record Revenues Overshadowed by £22M FlowBank Impairment

CoinShares’ Q2 2024 Record Revenues Overshadowed by £22M FlowBank Impairment

CoinShares’ Q2 2024 Record Revenues Overshadowed by £22M FlowBank Impairment

CoinShares’ Q2 2024 Record Revenues Overshadowed by £22M FlowBank Impairment

CoinShares’ Q2 2024 Record Revenues Overshadowed by £22M FlowBank Impairment

CoinShares’ Q2 2024 Record Revenues Overshadowed by £22M FlowBank Impairment

-

Bitcoin Sheds $320 Billion as Crypto Market Faces Steepest Decline since 2023

Bitcoin Sheds $320 Billion as Crypto Market Faces Steepest Decline since 2023

Bitcoin Sheds $320 Billion as Crypto Market Faces Steepest Decline since 2023

Bitcoin Sheds $320 Billion as Crypto Market Faces Steepest Decline since 2023

Bitcoin Sheds $320 Billion as Crypto Market Faces Steepest Decline since 2023

Bitcoin Sheds $320 Billion as Crypto Market Faces Steepest Decline since 2023

Bitcoin Sheds $320 Billion as Crypto Market Faces Steepest Decline since 2023

Bitcoin Sheds $320 Billion as Crypto Market Faces Steepest Decline since 2023

Bitcoin Sheds $320 Billion as Crypto Market Faces Steepest Decline since 2023

Bitcoin Sheds $320 Billion as Crypto Market Faces Steepest Decline since 2023

-

Ex-IronFX and LCG Sales Veteran Joins Taurex

Ex-IronFX and LCG Sales Veteran Joins Taurex

Ex-IronFX and LCG Sales Veteran Joins Taurex

Ex-IronFX and LCG Sales Veteran Joins Taurex

Ex-IronFX and LCG Sales Veteran Joins Taurex

Ex-IronFX and LCG Sales Veteran Joins Taurex

Ex-IronFX and LCG Sales Veteran Joins Taurex

Ex-IronFX and LCG Sales Veteran Joins Taurex

Ex-IronFX and LCG Sales Veteran Joins Taurex

Ex-IronFX and LCG Sales Veteran Joins Taurex

FinTech

-

UK Fintech Investment Soars to $7.3 Billion in H1: EMEA Investment Falls

UK Fintech Investment Soars to $7.3 Billion in H1: EMEA Investment Falls

UK Fintech Investment Soars to $7.3 Billion in H1: EMEA Investment Falls

UK Fintech Investment Soars to $7.3 Billion in H1: EMEA Investment Falls

UK Fintech Investment Soars to $7.3 Billion in H1: EMEA Investment Falls

UK Fintech Investment Soars to $7.3 Billion in H1: EMEA Investment Falls

UK Fintech Investment Soars to $7.3 Billion in H1: EMEA Investment Falls

UK Fintech Investment Soars to $7.3 Billion in H1: EMEA Investment Falls

UK Fintech Investment Soars to $7.3 Billion in H1: EMEA Investment Falls

UK Fintech Investment Soars to $7.3 Billion in H1: EMEA Investment Falls

-

Revolut Expands B2B Services to Singapore, Offering Global Payment Solutions

Revolut Expands B2B Services to Singapore, Offering Global Payment Solutions

Revolut Expands B2B Services to Singapore, Offering Global Payment Solutions

Revolut Expands B2B Services to Singapore, Offering Global Payment Solutions

Revolut Expands B2B Services to Singapore, Offering Global Payment Solutions

Revolut Expands B2B Services to Singapore, Offering Global Payment Solutions

Revolut Expands B2B Services to Singapore, Offering Global Payment Solutions

Revolut Expands B2B Services to Singapore, Offering Global Payment Solutions

Revolut Expands B2B Services to Singapore, Offering Global Payment Solutions

Revolut Expands B2B Services to Singapore, Offering Global Payment Solutions

-

eToro and Exness Lead on Social Media: 5.1 Million Followers Push Trading Dominance

eToro and Exness Lead on Social Media: 5.1 Million Followers Push Trading Dominance

eToro and Exness Lead on Social Media: 5.1 Million Followers Push Trading Dominance

eToro and Exness Lead on Social Media: 5.1 Million Followers Push Trading Dominance

eToro and Exness Lead on Social Media: 5.1 Million Followers Push Trading Dominance

eToro and Exness Lead on Social Media: 5.1 Million Followers Push Trading Dominance

eToro and Exness Lead on Social Media: 5.1 Million Followers Push Trading Dominance

eToro and Exness Lead on Social Media: 5.1 Million Followers Push Trading Dominance

eToro and Exness Lead on Social Media: 5.1 Million Followers Push Trading Dominance

eToro and Exness Lead on Social Media: 5.1 Million Followers Push Trading Dominance

-

India’s Cybersecurity Crisis: Ransomware Takes 300 Small Banks Offline

India’s Cybersecurity Crisis: Ransomware Takes 300 Small Banks Offline

India’s Cybersecurity Crisis: Ransomware Takes 300 Small Banks Offline

India’s Cybersecurity Crisis: Ransomware Takes 300 Small Banks Offline

India’s Cybersecurity Crisis: Ransomware Takes 300 Small Banks Offline

India’s Cybersecurity Crisis: Ransomware Takes 300 Small Banks Offline

India’s Cybersecurity Crisis: Ransomware Takes 300 Small Banks Offline

India’s Cybersecurity Crisis: Ransomware Takes 300 Small Banks Offline

India’s Cybersecurity Crisis: Ransomware Takes 300 Small Banks Offline

India’s Cybersecurity Crisis: Ransomware Takes 300 Small Banks Offline

-

Singapore’s M-DAQ Global Acquires Easy Pay Transfers to Boost Cross-Border Payments

Singapore’s M-DAQ Global Acquires Easy Pay Transfers to Boost Cross-Border Payments

Singapore’s M-DAQ Global Acquires Easy Pay Transfers to Boost Cross-Border Payments

Singapore’s M-DAQ Global Acquires Easy Pay Transfers to Boost Cross-Border Payments

Singapore’s M-DAQ Global Acquires Easy Pay Transfers to Boost Cross-Border Payments

Singapore’s M-DAQ Global Acquires Easy Pay Transfers to Boost Cross-Border Payments

Singapore’s M-DAQ Global Acquires Easy Pay Transfers to Boost Cross-Border Payments

Singapore’s M-DAQ Global Acquires Easy Pay Transfers to Boost Cross-Border Payments

Singapore’s M-DAQ Global Acquires Easy Pay Transfers to Boost Cross-Border Payments

Singapore’s M-DAQ Global Acquires Easy Pay Transfers to Boost Cross-Border Payments

-

eToro Launches Staking for Solana and Ethereum: Intro Days and Eligibility

eToro Launches Staking for Solana and Ethereum: Intro Days and Eligibility

eToro Launches Staking for Solana and Ethereum: Intro Days and Eligibility

eToro Launches Staking for Solana and Ethereum: Intro Days and Eligibility

eToro Launches Staking for Solana and Ethereum: Intro Days and Eligibility

eToro Launches Staking for Solana and Ethereum: Intro Days and Eligibility

eToro Launches Staking for Solana and Ethereum: Intro Days and Eligibility

eToro Launches Staking for Solana and Ethereum: Intro Days and Eligibility

eToro Launches Staking for Solana and Ethereum: Intro Days and Eligibility

eToro Launches Staking for Solana and Ethereum: Intro Days and Eligibility

-

UK Fintech Investment Soars to $7.3 Billion in H1: EMEA Investment Falls

UK Fintech Investment Soars to $7.3 Billion in H1: EMEA Investment Falls

-

Revolut Expands B2B Services to Singapore, Offering Global Payment Solutions

Revolut Expands B2B Services to Singapore, Offering Global Payment Solutions

-

eToro and Exness Lead on Social Media: 5.1 Million Followers Push Trading Dominance

eToro and Exness Lead on Social Media: 5.1 Million Followers Push Trading Dominance

-

India’s Cybersecurity Crisis: Ransomware Takes 300 Small Banks Offline

India’s Cybersecurity Crisis: Ransomware Takes 300 Small Banks Offline

Featured Videos

Louise Bedford | Trading Game| FMPS:24 Speaker Interviews

Louise Bedford | Trading Game| FMPS:24 Speaker Interviews

Louise Bedford | Trading Game| FMPS:24 Speaker Interviews

Louise Bedford | Trading Game| FMPS:24 Speaker Interviews

We had the pleasure to meet and interview bestselling author, trading expert and founder of the Trading Game, Louise Bedford and discuss her upcoming speaker sessions at the Finance Magnates Pacific Summit 2024. With over 30 years of trading experience, Louise shares insights on investing psychology secrets and emphasizes the importance of financial independence through trading. She highlights the current financial challenges, the need for personal responsibility, and the power of trading as a solution. Louise will cover mindset strategies, lessons learned from decades of trading, and practical advice to help traders achieve financial serenity and avoid common pitfalls. Get Your FREE Pass and meet Louise: httpss://bit.ly/4fsw6j2 📣 Stay updated with the latest in finance and trading! Follow FMevents across our social media platforms for news, insights, and event updates. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/showcase/financemagnates-events/ 👍 Facebook: httpss://www.facebook.com/FinanceMagnatesEvents 📸 Instagram: httpss://www.instagram.com/fmevents_official 🐦 Twitter: httpss://twitter.com/F_M_events 🎥 TikTok: httpss://www.tiktok.com/@fmevents_official ▶️ YouTube: httpss://www.youtube.com/@FinanceMagnates_official Don’t miss out on our latest videos, interviews, and event coverage. Subscribe to our YouTube channel for more!

We had the pleasure to meet and interview bestselling author, trading expert and founder of the Trading Game, Louise Bedford and discuss her upcoming speaker sessions at the Finance Magnates Pacific Summit 2024. With over 30 years of trading experience, Louise shares insights on investing psychology secrets and emphasizes the importance of financial independence through trading. She highlights the current financial challenges, the need for personal responsibility, and the power of trading as a solution. Louise will cover mindset strategies, lessons learned from decades of trading, and practical advice to help traders achieve financial serenity and avoid common pitfalls. Get Your FREE Pass and meet Louise: httpss://bit.ly/4fsw6j2 📣 Stay updated with the latest in finance and trading! Follow FMevents across our social media platforms for news, insights, and event updates. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/showcase/financemagnates-events/ 👍 Facebook: httpss://www.facebook.com/FinanceMagnatesEvents 📸 Instagram: httpss://www.instagram.com/fmevents_official 🐦 Twitter: httpss://twitter.com/F_M_events 🎥 TikTok: httpss://www.tiktok.com/@fmevents_official ▶️ YouTube: httpss://www.youtube.com/@FinanceMagnates_official Don’t miss out on our latest videos, interviews, and event coverage. Subscribe to our YouTube channel for more!

We had the pleasure to meet and interview bestselling author, trading expert and founder of the Trading Game, Louise Bedford and discuss her upcoming speaker sessions at the Finance Magnates Pacific Summit 2024. With over 30 years of trading experience, Louise shares insights on investing psychology secrets and emphasizes the importance of financial independence through trading. She highlights the current financial challenges, the need for personal responsibility, and the power of trading as a solution. Louise will cover mindset strategies, lessons learned from decades of trading, and practical advice to help traders achieve financial serenity and avoid common pitfalls. Get Your FREE Pass and meet Louise: httpss://bit.ly/4fsw6j2 📣 Stay updated with the latest in finance and trading! Follow FMevents across our social media platforms for news, insights, and event updates. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/showcase/financemagnates-events/ 👍 Facebook: httpss://www.facebook.com/FinanceMagnatesEvents 📸 Instagram: httpss://www.instagram.com/fmevents_official 🐦 Twitter: httpss://twitter.com/F_M_events 🎥 TikTok: httpss://www.tiktok.com/@fmevents_official ▶️ YouTube: httpss://www.youtube.com/@FinanceMagnates_official Don’t miss out on our latest videos, interviews, and event coverage. Subscribe to our YouTube channel for more!

We had the pleasure to meet and interview bestselling author, trading expert and founder of the Trading Game, Louise Bedford and discuss her upcoming speaker sessions at the Finance Magnates Pacific Summit 2024. With over 30 years of trading experience, Louise shares insights on investing psychology secrets and emphasizes the importance of financial independence through trading. She highlights the current financial challenges, the need for personal responsibility, and the power of trading as a solution. Louise will cover mindset strategies, lessons learned from decades of trading, and practical advice to help traders achieve financial serenity and avoid common pitfalls. Get Your FREE Pass and meet Louise: httpss://bit.ly/4fsw6j2 📣 Stay updated with the latest in finance and trading! Follow FMevents across our social media platforms for news, insights, and event updates. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/showcase/financemagnates-events/ 👍 Facebook: httpss://www.facebook.com/FinanceMagnatesEvents 📸 Instagram: httpss://www.instagram.com/fmevents_official 🐦 Twitter: httpss://twitter.com/F_M_events 🎥 TikTok: httpss://www.tiktok.com/@fmevents_official ▶️ YouTube: httpss://www.youtube.com/@FinanceMagnates_official Don’t miss out on our latest videos, interviews, and event coverage. Subscribe to our YouTube channel for more!

-

Pere Monguió Montells | FXStreet

Pere Monguió Montells | FXStreet

Pere Monguió Montells | FXStreet

Pere Monguió Montells | FXStreet

Pere Monguió Montells | FXStreet

Pere Monguió Montells | FXStreet

In this video, @fxstreet Co-CEO Guillermo Parada met with us at iFX EXPO International 2024 to discuss their campaign to prevent scams in the trading industry. He highlights the importance of educating traders to protect themselves and clarifying what to expect from reputable brokers. Guillermo outlines three layers of protection: trader awareness, brand responsibility, and platform regulation. Guillermo concludes by detailing FXStreet’s future plans, including launching broker reviews and building strong trading communities on social media. #financemagnates #fxstreet #trading #scamprevention #financenews #financeindustry #financialnews #tradingnews 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, @fxstreet Co-CEO Guillermo Parada met with us at iFX EXPO International 2024 to discuss their campaign to prevent scams in the trading industry. He highlights the importance of educating traders to protect themselves and clarifying what to expect from reputable brokers. Guillermo outlines three layers of protection: trader awareness, brand responsibility, and platform regulation. Guillermo concludes by detailing FXStreet’s future plans, including launching broker reviews and building strong trading communities on social media. #financemagnates #fxstreet #trading #scamprevention #financenews #financeindustry #financialnews #tradingnews 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, @fxstreet Co-CEO Guillermo Parada met with us at iFX EXPO International 2024 to discuss their campaign to prevent scams in the trading industry. He highlights the importance of educating traders to protect themselves and clarifying what to expect from reputable brokers. Guillermo outlines three layers of protection: trader awareness, brand responsibility, and platform regulation. Guillermo concludes by detailing FXStreet’s future plans, including launching broker reviews and building strong trading communities on social media. #financemagnates #fxstreet #trading #scamprevention #financenews #financeindustry #financialnews #tradingnews 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, @fxstreet Co-CEO Guillermo Parada met with us at iFX EXPO International 2024 to discuss their campaign to prevent scams in the trading industry. He highlights the importance of educating traders to protect themselves and clarifying what to expect from reputable brokers. Guillermo outlines three layers of protection: trader awareness, brand responsibility, and platform regulation. Guillermo concludes by detailing FXStreet’s future plans, including launching broker reviews and building strong trading communities on social media. #financemagnates #fxstreet #trading #scamprevention #financenews #financeindustry #financialnews #tradingnews 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, @fxstreet Co-CEO Guillermo Parada met with us at iFX EXPO International 2024 to discuss their campaign to prevent scams in the trading industry. He highlights the importance of educating traders to protect themselves and clarifying what to expect from reputable brokers. Guillermo outlines three layers of protection: trader awareness, brand responsibility, and platform regulation. Guillermo concludes by detailing FXStreet’s future plans, including launching broker reviews and building strong trading communities on social media. #financemagnates #fxstreet #trading #scamprevention #financenews #financeindustry #financialnews #tradingnews 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, @fxstreet Co-CEO Guillermo Parada met with us at iFX EXPO International 2024 to discuss their campaign to prevent scams in the trading industry. He highlights the importance of educating traders to protect themselves and clarifying what to expect from reputable brokers. Guillermo outlines three layers of protection: trader awareness, brand responsibility, and platform regulation. Guillermo concludes by detailing FXStreet’s future plans, including launching broker reviews and building strong trading communities on social media. #financemagnates #fxstreet #trading #scamprevention #financenews #financeindustry #financialnews #tradingnews 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

-

Andrew Lane | Acuity

Andrew Lane | Acuity

Andrew Lane | Acuity

Andrew Lane | Acuity

Andrew Lane | Acuity

Andrew Lane | Acuity

During iFX EXPO International 2024, we had the pleasure to interview Andrew Loveridge from Acuity Trading. He discusses the evolving financial trading industry and the impact of AI, regulation, and technological advancements. He highlights the importance of natural language processing (NLP) and sentiment analysis in trading, detailing how these technologies are used to extract valuable data from text for trading purposes. Andrew also introduces their latest innovation, which merges technical analysis with sentiment analysis to provide more comprehensive trading tools. #financemagnates #Acuity #trading #AI #NLP #financenews #financeindustry #financialnews #tradingnews 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

During iFX EXPO International 2024, we had the pleasure to interview Andrew Loveridge from Acuity Trading. He discusses the evolving financial trading industry and the impact of AI, regulation, and technological advancements. He highlights the importance of natural language processing (NLP) and sentiment analysis in trading, detailing how these technologies are used to extract valuable data from text for trading purposes. Andrew also introduces their latest innovation, which merges technical analysis with sentiment analysis to provide more comprehensive trading tools. #financemagnates #Acuity #trading #AI #NLP #financenews #financeindustry #financialnews #tradingnews 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

During iFX EXPO International 2024, we had the pleasure to interview Andrew Loveridge from Acuity Trading. He discusses the evolving financial trading industry and the impact of AI, regulation, and technological advancements. He highlights the importance of natural language processing (NLP) and sentiment analysis in trading, detailing how these technologies are used to extract valuable data from text for trading purposes. Andrew also introduces their latest innovation, which merges technical analysis with sentiment analysis to provide more comprehensive trading tools. #financemagnates #Acuity #trading #AI #NLP #financenews #financeindustry #financialnews #tradingnews 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

During iFX EXPO International 2024, we had the pleasure to interview Andrew Loveridge from Acuity Trading. He discusses the evolving financial trading industry and the impact of AI, regulation, and technological advancements. He highlights the importance of natural language processing (NLP) and sentiment analysis in trading, detailing how these technologies are used to extract valuable data from text for trading purposes. Andrew also introduces their latest innovation, which merges technical analysis with sentiment analysis to provide more comprehensive trading tools. #financemagnates #Acuity #trading #AI #NLP #financenews #financeindustry #financialnews #tradingnews 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

During iFX EXPO International 2024, we had the pleasure to interview Andrew Loveridge from Acuity Trading. He discusses the evolving financial trading industry and the impact of AI, regulation, and technological advancements. He highlights the importance of natural language processing (NLP) and sentiment analysis in trading, detailing how these technologies are used to extract valuable data from text for trading purposes. Andrew also introduces their latest innovation, which merges technical analysis with sentiment analysis to provide more comprehensive trading tools. #financemagnates #Acuity #trading #AI #NLP #financenews #financeindustry #financialnews #tradingnews 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

During iFX EXPO International 2024, we had the pleasure to interview Andrew Loveridge from Acuity Trading. He discusses the evolving financial trading industry and the impact of AI, regulation, and technological advancements. He highlights the importance of natural language processing (NLP) and sentiment analysis in trading, detailing how these technologies are used to extract valuable data from text for trading purposes. Andrew also introduces their latest innovation, which merges technical analysis with sentiment analysis to provide more comprehensive trading tools. #financemagnates #Acuity #trading #AI #NLP #financenews #financeindustry #financialnews #tradingnews 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

-

James Glyde | Pipfarm

James Glyde | Pipfarm

James Glyde | Pipfarm

James Glyde | Pipfarm

James Glyde | Pipfarm

James Glyde | Pipfarm

In this video, James Glide from PipFarm discusses the current state and future of the prop trading industry. He explains how Pip Farm uses gamification to manage risk, allowing traders to unlock features like higher leverage and faster payouts by earning experience points through achievements. James addresses the inherent risk management challenges in prop trading and the importance of building a track record with traders. He touches on revenue structure, emphasizing the need for a larger client base to make trading initiatives profitable. James also discusses potential regulatory changes and Pip Farm’s readiness to adapt. The session concludes with a focus on consistency and continuous improvement in their offerings. #financemagnates #pipfarm #financialnews #tradingnews #PropTrading #RiskManagement #Gamification #TradingStrategies #FinancialRegulation 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, James Glide from PipFarm discusses the current state and future of the prop trading industry. He explains how Pip Farm uses gamification to manage risk, allowing traders to unlock features like higher leverage and faster payouts by earning experience points through achievements. James addresses the inherent risk management challenges in prop trading and the importance of building a track record with traders. He touches on revenue structure, emphasizing the need for a larger client base to make trading initiatives profitable. James also discusses potential regulatory changes and Pip Farm’s readiness to adapt. The session concludes with a focus on consistency and continuous improvement in their offerings. #financemagnates #pipfarm #financialnews #tradingnews #PropTrading #RiskManagement #Gamification #TradingStrategies #FinancialRegulation 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, James Glide from PipFarm discusses the current state and future of the prop trading industry. He explains how Pip Farm uses gamification to manage risk, allowing traders to unlock features like higher leverage and faster payouts by earning experience points through achievements. James addresses the inherent risk management challenges in prop trading and the importance of building a track record with traders. He touches on revenue structure, emphasizing the need for a larger client base to make trading initiatives profitable. James also discusses potential regulatory changes and Pip Farm’s readiness to adapt. The session concludes with a focus on consistency and continuous improvement in their offerings. #financemagnates #pipfarm #financialnews #tradingnews #PropTrading #RiskManagement #Gamification #TradingStrategies #FinancialRegulation 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, James Glide from PipFarm discusses the current state and future of the prop trading industry. He explains how Pip Farm uses gamification to manage risk, allowing traders to unlock features like higher leverage and faster payouts by earning experience points through achievements. James addresses the inherent risk management challenges in prop trading and the importance of building a track record with traders. He touches on revenue structure, emphasizing the need for a larger client base to make trading initiatives profitable. James also discusses potential regulatory changes and Pip Farm’s readiness to adapt. The session concludes with a focus on consistency and continuous improvement in their offerings. #financemagnates #pipfarm #financialnews #tradingnews #PropTrading #RiskManagement #Gamification #TradingStrategies #FinancialRegulation 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, James Glide from PipFarm discusses the current state and future of the prop trading industry. He explains how Pip Farm uses gamification to manage risk, allowing traders to unlock features like higher leverage and faster payouts by earning experience points through achievements. James addresses the inherent risk management challenges in prop trading and the importance of building a track record with traders. He touches on revenue structure, emphasizing the need for a larger client base to make trading initiatives profitable. James also discusses potential regulatory changes and Pip Farm’s readiness to adapt. The session concludes with a focus on consistency and continuous improvement in their offerings. #financemagnates #pipfarm #financialnews #tradingnews #PropTrading #RiskManagement #Gamification #TradingStrategies #FinancialRegulation 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, James Glide from PipFarm discusses the current state and future of the prop trading industry. He explains how Pip Farm uses gamification to manage risk, allowing traders to unlock features like higher leverage and faster payouts by earning experience points through achievements. James addresses the inherent risk management challenges in prop trading and the importance of building a track record with traders. He touches on revenue structure, emphasizing the need for a larger client base to make trading initiatives profitable. James also discusses potential regulatory changes and Pip Farm’s readiness to adapt. The session concludes with a focus on consistency and continuous improvement in their offerings. #financemagnates #pipfarm #financialnews #tradingnews #PropTrading #RiskManagement #Gamification #TradingStrategies #FinancialRegulation 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

-

Andreas C. Kapsos | Match-Prime Liquidity

Andreas C. Kapsos | Match-Prime Liquidity

Andreas C. Kapsos | Match-Prime Liquidity

Andreas C. Kapsos | Match-Prime Liquidity

Andreas C. Kapsos | Match-Prime Liquidity

Andreas C. Kapsos | Match-Prime Liquidity

We had the chance to meet with Match-Prime Liquidity’s CEO, Andreas Kapsos to discuss the evolving landscape of liquidity in the trading industry at the Cyprus Expo. He highlights the increasing demand for new asset types like crypto CFDs and the role of AI in predictive analysis and sentiment tracking. Emphasizing the importance of multiple liquidity providers, he explains that having more than one provider offers better security and comparison opportunities for clients. The conversation also touches on the consolidation trend in the liquidity space and the challenges new entrants face due to high entry barriers and sophisticated market demands. #financemagnates #financialnews #TradingIndustry #Liquidity #CryptoCFDs #AIinFinance #FinancialExpo 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

We had the chance to meet with Match-Prime Liquidity’s CEO, Andreas Kapsos to discuss the evolving landscape of liquidity in the trading industry at the Cyprus Expo. He highlights the increasing demand for new asset types like crypto CFDs and the role of AI in predictive analysis and sentiment tracking. Emphasizing the importance of multiple liquidity providers, he explains that having more than one provider offers better security and comparison opportunities for clients. The conversation also touches on the consolidation trend in the liquidity space and the challenges new entrants face due to high entry barriers and sophisticated market demands. #financemagnates #financialnews #TradingIndustry #Liquidity #CryptoCFDs #AIinFinance #FinancialExpo 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

We had the chance to meet with Match-Prime Liquidity’s CEO, Andreas Kapsos to discuss the evolving landscape of liquidity in the trading industry at the Cyprus Expo. He highlights the increasing demand for new asset types like crypto CFDs and the role of AI in predictive analysis and sentiment tracking. Emphasizing the importance of multiple liquidity providers, he explains that having more than one provider offers better security and comparison opportunities for clients. The conversation also touches on the consolidation trend in the liquidity space and the challenges new entrants face due to high entry barriers and sophisticated market demands. #financemagnates #financialnews #TradingIndustry #Liquidity #CryptoCFDs #AIinFinance #FinancialExpo 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

We had the chance to meet with Match-Prime Liquidity’s CEO, Andreas Kapsos to discuss the evolving landscape of liquidity in the trading industry at the Cyprus Expo. He highlights the increasing demand for new asset types like crypto CFDs and the role of AI in predictive analysis and sentiment tracking. Emphasizing the importance of multiple liquidity providers, he explains that having more than one provider offers better security and comparison opportunities for clients. The conversation also touches on the consolidation trend in the liquidity space and the challenges new entrants face due to high entry barriers and sophisticated market demands. #financemagnates #financialnews #TradingIndustry #Liquidity #CryptoCFDs #AIinFinance #FinancialExpo 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

We had the chance to meet with Match-Prime Liquidity’s CEO, Andreas Kapsos to discuss the evolving landscape of liquidity in the trading industry at the Cyprus Expo. He highlights the increasing demand for new asset types like crypto CFDs and the role of AI in predictive analysis and sentiment tracking. Emphasizing the importance of multiple liquidity providers, he explains that having more than one provider offers better security and comparison opportunities for clients. The conversation also touches on the consolidation trend in the liquidity space and the challenges new entrants face due to high entry barriers and sophisticated market demands. #financemagnates #financialnews #TradingIndustry #Liquidity #CryptoCFDs #AIinFinance #FinancialExpo 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

We had the chance to meet with Match-Prime Liquidity’s CEO, Andreas Kapsos to discuss the evolving landscape of liquidity in the trading industry at the Cyprus Expo. He highlights the increasing demand for new asset types like crypto CFDs and the role of AI in predictive analysis and sentiment tracking. Emphasizing the importance of multiple liquidity providers, he explains that having more than one provider offers better security and comparison opportunities for clients. The conversation also touches on the consolidation trend in the liquidity space and the challenges new entrants face due to high entry barriers and sophisticated market demands. #financemagnates #financialnews #TradingIndustry #Liquidity #CryptoCFDs #AIinFinance #FinancialExpo 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: httpss://www.linkedin.com/company/financemagnates/ 👍 Facebook: httpss://www.facebook.com/financemagnates/ 📸 Instagram: httpss://www.instagram.com/financemagnates_official 🐦 X (Twitter): httpss://twitter.com/financemagnates/ 📡 RSS Feed: httpss://www.financemagnates.com/feed/ ▶️ Telegram: httpss://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔